With the launch of the India Gas Exchange (IGX) on 15 June 2020, will industry players check-off one box in their long wish list for the natural gas industry in India? Perhaps, but not without some hesitation as there are far too many uncertainties in the evolution of the exchange into a full-blown gas trading platform. IGX is an automated trading platform for imported liquefied natural gas (LNG) that will allow buyers and sellers to trade on the spot as well as the forward market across three physical hubs, Dahej and Hazira in Gujarat and Kakinada in Andhra Pradesh. Price discovery is through double-sided closed auctions in which members place buy or sell bids based on their customized requirement. The hope is that the IGX will generate clear signals for making rational economic decisions over consumption and investments in the currently fragmented and relatively opaque gas sector in India.

Source: IGX

Strong Tailwinds

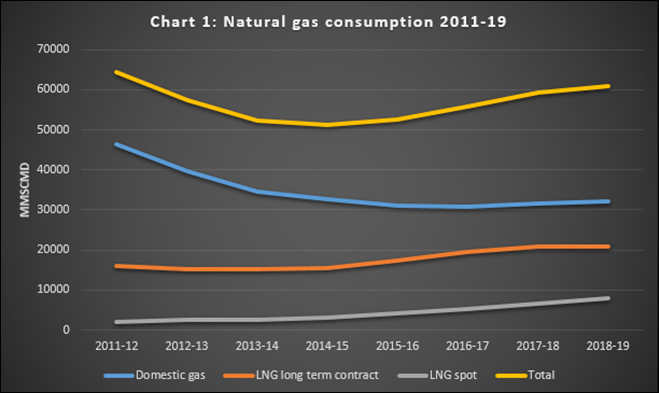

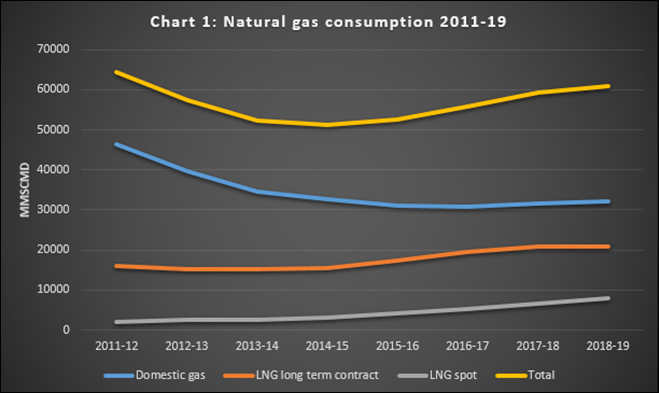

There are strong tailwinds that IGX can count on for growth. There is a strong policy-push from the government with the stated goal of increasing the share of natural gas in India’s commercial energy basket to 15 percent from the current 6 percent by 2030. There is optimism over government plans to gradually introduce pricing and marketing freedom for natural gas and rationalise pipeline tariffs to help push for a greater share gas. There are government plans to increase the pipeline network from about 16,000 km to about 27,000 km in the next decade. By 2023, at least 20 million tonnes (MT) of additional LNG regasification capacity is expected to come on-stream. There is strong demand-pull from low spot prices that are below $3/mmBtu (metric million British thermal units) for Asian markets. Spot prices are now comparable to the regulated gas price of $2.39/mmBtu set for domestic gas making spot LNG attractive even for the most price sensitive buyer. Indian importers bought roughly half of LNG through spot trade in 2019 (chart 1). LNG imports increased by 25 percent in January compared to the previous year and by a record 68 percent in February. The International Energy Agency (IEA) projects India as the most attractive market for LNG after China with a 28 BCM (billion cubic meter) increase per year in the next five years as long as the government continues to implement progressive policies.

A Liquid Market for Gas?

IGX is definitely a bold initiative by the India Energy Exchange (IEX) given that the Indian gas sector is short on many of the hallmarks of a typical gas-trading hub on supply, demand, infrastructure and price. Unlike other mature gas hubs through which multiple sources of supply from domestic production, cross border pipeline gas as well as LNG flows, the IGX will preside over only spot LNG shipments for now. Government policy will continue to direct the flow and pricing of most of the domestic gas output that accounts for about 47 percent of the total consumption.

Source: IGX for 2019, PNGRB for 2004 & 2010

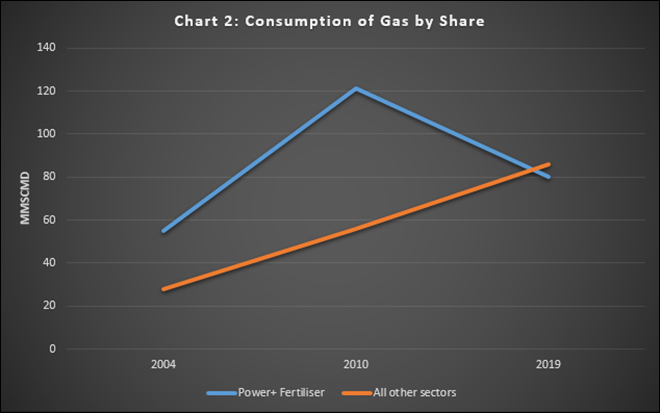

A strong consumer base with competing buying interests like power generation, industrial consumers and households that is necessary for developing a diverse market place is evolving in India but these sectors are price sensitive. The power and fertilizer industries along with city gas distribution (CGD) networks that cater to household and transport demand accounted for 66 percent of gas demand in the country in 2019 but roughly half this demand was met with low priced domestic gas. However, the share of gas consumed by sectors other than power and fertilizer that are most sensitive to prices exceeded the share consumed by the two price sensitive segments in 2019 (chart 2). If this positive trend continues, the influence of the market over gas supplies can increase in the future.

In the short term the government could mandate that a share of domestic gas (including all other domestic production such as CBM [coal bed methane], HTHP [high temperature high pressure] gas, deep-water gas, ultra-deep-water gas and pre-NELP [new exploration & licencing policy] gas with marketing freedom) and LNG to be transacted on the hub. Nevertheless, in the longer term, substantial increase in the supply of tradable gas; gas storage facilities; a competitive wholesale natural gas market; non-discriminatory third-party pipeline access; standardized contracts for both transportation and the sale and purchase of gas; liquid physical markets that encourage the development of a futures market and price reporting are critical for IGX to mature into a liquid gas trading hub.

The experience of China, Japan, and Singapore in developing LNG hubs offers some key insights in this regard. Though these hubs have been in the making for about a decade, they are yet to develop into trading platforms comparable to the henry hub in the USA or the national balancing point (NBP) in the UK. One of the primary reasons is that there is no competitive wholesale market for gas in these countries. China’s gas market that is roughly five times the size of the Indian gas market is yet to separate transport and commercial activities and it is yet to introduce third party access to infrastructure. The same is true for Japan. Though Singapore is a liberalized market, its domestic market that is only a fourth of India’s market size is too small and it does not have enough market players to create the truly competitive wholesale market that is a prerequisite for a hub.

Unlike pipeline supply based hubs in the USA and Europe where receipts and deliveries are continuous and almost instantaneous, the size of a single cargo of LNG and the uneven nature of deliveries limits liquidity in LNG hubs. With LNG, there is no clear geographic location where a traded cargo would automatically default to delivery if the parties to the trade wished to do so. This fundamental feature of pipeline hubs cannot be easily replicated in LNG hubs.

Notwithstanding the challenges, IGX is the step in the right direction. The first few days of trading has revealed a price $4.07/mmBtu for imported gas, which means that domestic gas is grossly under-priced. Under-pricing of domestic gas is undermining domestic production while stimulating demand. IGX pricing signals will address the problem of multiple and suboptimal and non-representative pricing mechanisms that have led to price distortion and unfair competition amongst consumers. Price distortion is a serious impediment to the goal of transition to a gas-based economy as it discourages investment both on supply and demand. From a strategic perspective, the perceived supply risk generally associated with imported LNG will be reduced by IGX. The eventual development of a transparent and liquid gas market mediated by IGX may lead to a “gas price index” that will capture market price of gas in India. This will reduce the premium on imported LNG that arises from dependence indexation to foreign gas or crude markers. The right price will send the right signals to the market on investment requirements in the gas value chain and will facilitate more efficient usage of gas.

-By L.Powell